All You Need to Know about

Multi-Fund Structure

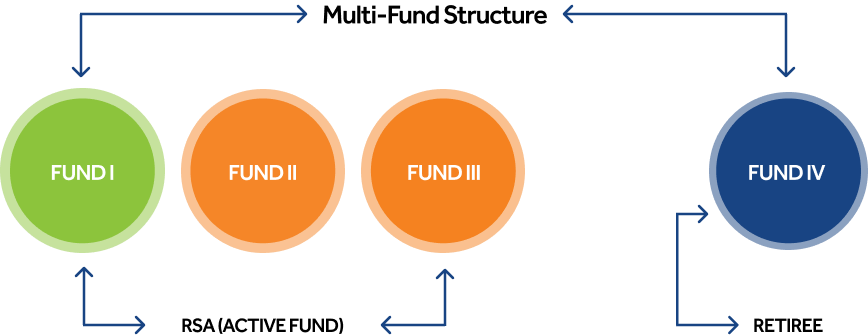

Multi-Fund structure is a framework that aims to match your age and risk profile to one of four distinct RSA funds – i.e. three RSA Fund types for active contributors and one Retiree Fund for retired contributors.

Differentiating Between Funds and

Their Characteristics

Funds must differ by Allocation to Variable Income (VI) Securities

This Fund is only open to persons aged 49 and below and must be requested for by the Contributor. It has the highest exposure to variable income instruments. Active contributors above the age of 50 and Retirees are not eligible to access this Fund

Fund II is open to active contributors who were aged 49 as at their last birthday and below. This Fund has a moderate exposure to variable income instruments

Fund III is the default fund for active contributors aged 50 years and above. Compared to Funds I & II, Fund III has a considerably lower exposure to variable income instruments

Fund IV is strictly for Retirees. It has the lowest exposer to variable income instruments and the highest exposure to fixed income instruments

Why Segregate Based on Risk Appetite?

- Studies have shown that there is a greater possibility of generating higher returns by increasing the risk exposure of a portfolio.

- The more risk averse an investor, the less of his or her portfolio should be exposed to Variable Income Securities (such as Equities).

- Investment instruments whose income cannot be predetermined at the time of investment are called Variable Income Securities and are distinguished from Fixed Income Securities that have a predetermined income. Hence Variable Income Investments are generally classified as higher risk investments.

- Age relates to investment horizon. The longer the time horizon of an investor, the greater the proportion of the portfolio that should be in Variable Income Securities(such as Equities).

- The Multi Fund Structure provides more alignment between your retirement goals, risk appetite and age. Consequently, there will be a better chance for your pension assets to meet your expectations when you retire.

- HAPPY WORKERS' DAY

Your Questions Answered.

Frequently Asked Questions

For further enquiries on the Multi-Fund structure, kindly send an email to info@accesspensions.ng

From July 2, 2018, if you are 49 years and below at your last recorded birthday, you will by default be categorised into Fund II. If you are 50 years and above but still in active service, you will by default fall into Fund III. The Retiree Fund which is Fund IV, will remain unchanged – for retired contributors.

The unit value on all Funds will be published daily on our website and the Annual Financial Reports of the RSA Funds of all PFAs are published in at least 2 national dailies.

The balance in your RSA will not change due to the movement to the Multi-Fund Structure because your entire balance will be moved, hence at inception your balance remains the same.

No, this is not possible because you are only identified with one PIN and cannot be allowed to have contributions in more than one Fund structure at the same time.

No, your Additional Voluntary Contributions will be in the same Fund as your mandatory contributions.